This is a checklist of key issues for any local authorities considering purchasing a solar farm

This is a checklist of key issues for any local authority considering purchasing a solar farm.

This note does not deal with local authorities constructing their own solar farm assets (albeit a number of the same issues would apply). Nor does this note deal with local authority solar PV in a housing setting.

This checklist has been produced by Sharpe Pritchard LLP and is a high-level summary of key issues only. It should not be read as being definitive guidance. Detailed legal advice should be sought before entering into or considering any solar farm purchase and reliance should not be placed on this document in the context of any specific transaction. One thing we want local authorities to take from this note this that local authority purchase of major solar farm assets CAN be done. Not only this but it has been done on a number of occasions already. We have clients that have purchased or developed solar assets both in-house and via a company. We appreciate that developing a major solar project is outside the comfort zone of lots of local authority legal advisers (who are already very busy) as such we are here to help. This checklist provides a high-level summary of some of the key considerations local authority legal advisers might need to consider when considering any purchase of solar farm assets. This list is not definitive but hopefully it provides a good steer as to key issues that may be relevant to any transaction you are contemplating.

Please note this checklist does not cover wider issues such as development of business cases and carbon accounting — which are often material considerations in purchasing any solar farm.

The following phases are considered

Background to purchase of a solar farm

The following activities occur at each of these phases:

- Project Development – At this stage a developer will:

- Pick a site.

- Tackle land issues (lease vs freehold).

- Produce the outline design.

- Seek Planning (this is typically planning consent from the relevant local planning authority under the Town and Country Planning Act regime).

- Commission surveys including solar feasibility of site (i.e. irradiation).

- Conduct Environmental Impact Assessments.

- Obtain a generation licence. This is needed under the Electricity Act 1989 (although there are exemptions for sites with less than 100MW and that does not export more than 50MW). Supply and Distribution licences may also be required (or exemptions therefrom).

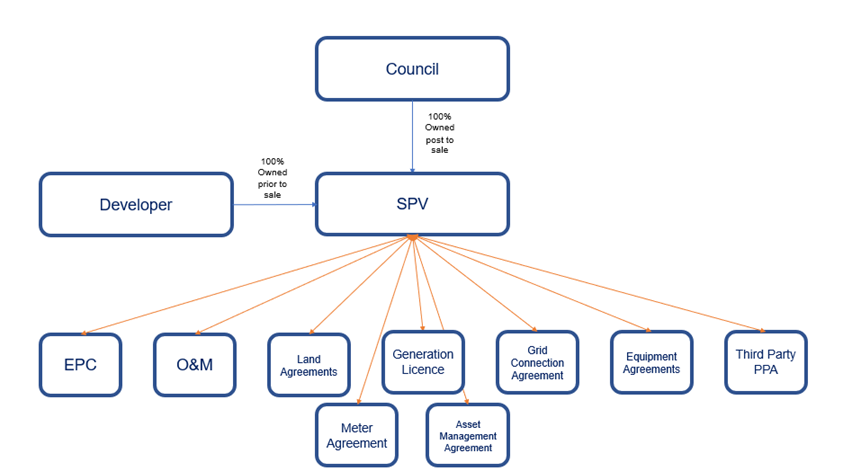

- Contracting – At this stage a developer will put in place key agreements. The key agreements to deliver any solar farm are likely to include the following (note the diagram below assumes a 100% local authority owned structure for simplicity):

The EPC Agreement is effectively the construction contract to build and install the solar farm (where a local authority is building the assets themselves there may be multiple construction arrangements including an owners engineer to manage outline design). Further equipment agreements may or may not be required in any particular instance.

The O&M Agreement is the contract under which the solar farm will be operated and maintained.

Land agreements will include arrangements for the site on which the solar farm is situated. They may also include rights over land to facilitate access (both for vehicles and any electricity connections).

The Generation Licence is issued by Ofgem. It has standard terms and conditions which are not subject to negotiation. There are certain limited scenarios where the Generation Licence is not required.

Critically a grid connection agreement will be required in most scenarios (only where a project is a pure private wire project will it be the case that a grid connection agreement is not required). Grid connections may allow for import and export. Grid connections can be costly and take a long time to procure. As such grid connections should be implemented as early as possible.

Third Party Power Purchase Agreements will be needed to export the power from the solar assets to a third party. A Power Purchase Agreement is an agreement under which power is sold.

Metering and Asset Management Agreements are typically required in order to ensure the solar assets are operated in accordance with relevant grid rules and requirements.

- Build – This is the phase in which the solar assets are constructed. This will be undertaken in accordance with the EPC Agreement. Local authorities may require project management services to police the EPC Agreement.

- Commissioning and Testing – During this phase the works are tested to ensure power output and other deliverables have been achieved. The EPC Agreement should set out detailed completion and commissioning requirements. These should be designed to meet commitments under the PPA as well as requirements of any Grid Connection Agreement and Land Agreements. Performance Guarantees will often be implemented under the EPC Agreement to ensure the contractor is held to required levels of performance.

- Operations – During this phase the plant will be operated, and power sold under the PPA. The site will be run by the Asset Manager. They will ensure that the solar plant is managed effectively. Where the solar plant also has battery storage then asset management arrangements may be more complex.

- Decommissioning – At this stage the plant is wound down. It is likely that under planning and Land Agreements that assets will need to be deconstructed the site restored.

Purchase of solar farm assets can happen at a number of times and in a number of ways. Perhaps the safest time to purchase is post Commissioning and Testing. This allows the local authority to ensure that what it is purchasing has been delivered (and cut out construction risk). However it is increasingly common for purchase to occur at the end of the Contracting Phase. Warranties required will vary in each instance.

In terms of the actual sale process this can happen by way of share or asset purchase – although a share purchase of an SPV is most common. Sale processes can be bi-lateral negotiations – i.e. between seller and local authority buyer but are likely to be part of a competitive equity sale process. Under this process, buyers have a limited period to carry out due diligence on work done by the developer up to the end of the contracting stage.

Checklist area 1 – have development phase basics been undertaken

Unlike other areas and aspects of this Checklist, this Area 1 comprises some of the key initial considerations. Before taking any initial view as to whether a solar farm purchase is viable it is critical to explore at least these initial questions.

| CHECKLIST AREA | CONSIDERED? |

| Has a suitable width=”100%” site been identified? | ☐ Yes ☐ No |

| Have rights for the site been acquired.? This should include all land required. Including any land for grid access. Typically the approach may be an option and lease agreement. | ☐ Yes ☐ No |

| Has land due diligence been undertaken? This should include usual checks but also a commissioning survey and reports to assess the project’s feasibility. | ☐ Yes ☐ No |

| Has the solar viability of the site been considered? For example has a solar resource assessment to assess irradiation levels been done? | ☐ Yes ☐ No |

| Are title reviews of the land available and are any major property red flags identified? Eventually a full report should be commissioned on the title or certificate on the title for sites (to establish legal title and assess for whether third party consents or insurance is required). | ☐ Yes ☐ No |

| Environmental Impact Assessments (EIA) – Are they required? Are they undertaken? | ☐ Yes ☐ No |

| Planning application submissions – Have these been made? | ☐ Yes ☐ No |

| Has planning consent been secured? Always check the conditions to any planning consent. Are they appropriate? | ☐ Yes ☐ No |

| Have third party and regulatory consents obtained? Third party consents will vary from project to project. | ☐ Yes ☐ No |

| Is a Grid Connection Agreement or Grid Connection Offer in place? It is important to look at the exact nature of any Grid Connection Offer or Agreement. This includes timing, cost and constraint risk. | ☐ Yes ☐ No |

| If capital is required for purchase – has an examination been undertaken as to government support schemes and other relevant schemes available? | ☐ Yes ☐ No |

| Have you produced a finance model which reflects provisions made in the key project agreements and which contains assumptions for the cost of financing and revenues. It is critical to identify long-term likely revenue streams sufficient to ensure your solar farm can meet its liabilities and likely costs. | ☐ Yes ☐ No |

| Have potential counterparties been identified and are any tendering and negotiation of key project agreements complete? | ☐ Yes ☐ No |

Checklist area 2 – how are you buying the solar farm

A number of key questions arise as to how the solar farm is to be purchased. This includes local authorities asking all of the following questions:

| CHECKLIST AREA | CONSIDERED? |

| After the purchase, will the local authority be the sole owner of the solar farm? | ☐ Yes ☐ No |

| If the local authority is not to be the sole owner, will ownership be shared with the developer or with a third party? If a third party, will it be another public body? | ☐ Yes ☐ No |

| How will ownership be transferred to the local authority? Will it be a share purchase or an asset purchase? Typically a share purchase is preferred due to complexity of transferring contracts to a new vehicle however this is not always the case. | ☐ Yes ☐ No |

| Where a share purchase is taking place, has detailed due diligence on the company being acquired been undertaken? This may include questions in respect of: Existing liabilities. Sufficiency of contracts (including those above). Disclosures regarding any issues or incidents. | ☐ Yes ☐ No |

| Where an asset transfer is taking place, how will assets be transferred and what is the new vehicle in which assets will be held? How will transfer of certain key agreements take place (for example the generation licence)? | ☐ Yes ☐ No |

| Have the procurement implications of an asset or share purchase been contemplated? See further below. Novation of agreements to local authorities can often count as letting of a new agreement. Similarly a share purchase negotiated with just one developer may raise procurement implications where that developer will be retained in some capacity to continue to provide services. In any event, consideration should be given where bi-lateral negotiations are taking place to make sure the local authority has achieved best value in determining which site to select. | ☐ Yes ☐ No |

| What corporate vehicle will deliver the solar farm? Consider the options including a company limited by shares, company limited by guarantee and a limited liability partnership (note there are a number of other options too). Typically such transactions are done by way of a company limited by shares, but LLPs may well present tax and accounting advantages. Notionally the local authority could also hold the assets in house. | ☐ Yes ☐ No |

| How will the local authority fund any purchase price? Consider cost efficacy and in particular consider: Various public grants. Reserves and PWLB. Bank loans and private finance. Capital from a JV partner. Municipal Bond Agency. Community Bonds. UKIB. Think about tax and legal powers in conjunction with this. | ☐ Yes ☐ No |

| If working with another local authority to fund the transaction, consider structure options. Multi-authority roles on projects could entail joint ownership, leasing structures, one authority as offtaker or lender to another. If working together, consider how to bid together and consider: Inter-authority agreements (s.101 LGA 1972) Joint committees (s.102 LGA 1972) Power to make staff available (s.113 LGA 1972) Power to provide goods, services and works to another public body (s.1 Local Authorities (Goods and Services) Act 1970) | ☐ Yes ☐ No |

| At what point in time will you purchase the solar farm? Is it at the end of the Contracting Phase or the end of the Commissioning and Testing Phase? Have you undertaken appropriate due diligence in each case. This effectively boils down to two options (although variants are possible) for a share purchase transaction as follows: Option 1 – Share Transfer Pre-Construction and Completion: The local authority purchases shares in the SPV that owns the project rights from a developer (i.e. land, planning consent and grid connection offer) at the end of the Project Development/Contracting Phase. They then proceed to construct and operate the solar farm within that SPV. Option 2 – Share Transfer Post-Construction: The local authority purchases the shares in the SPV that owns project rights and constructed and commissioned assets from a developer (i.e. land, planning consent and grid connection offer). They then proceed to operate the solar farm within that SPV. | ☐ Yes ☐ No |

Checklist area 3 – areas of due diligence/share purchase agreements based on timing of the transaction

Warranties and share purchase arrangements tend to be bespoke when a solar farm project is purchased prior to commissioning and testing. A critical part of review in such a scenario will be ensuring there is a route to put in place all relevant agreements on acceptable width=”100%” border=1 terms. What follows are some of the standard concerns where the local authority proposes to purchase the solar farm following testing and commissioning:

| CHECKLIST AREA | CONSIDERED? |

| When does payment occur? Is it all in one lump sum? Typically it may be better to ensure completion has occurred. However in some cases payment in advance can be made subject to appropriate security arrangements. A particular challenge with entering into a share purchase post-completion can be that developers struggle to raise sufficient finance to build out the project. In this respect, it is not uncommon for developers to seek some payment under an SPA in advance. These funds are used to secure grid connections and undertake other activities (again depending on the advance this can increasingly raise procurement risk – as it can make a share purchase agreement seem more like a works contract). Where any advance payments are made appropriate security would need to be taken (e.g. charges on developer assets). Such securities are not (of themselves) a solution for issues with the project and any advance should be considered in detail. | ☐ Yes ☐ No |

| Does your share purchase arrangement include some or more of the following: | |

| Deductions from the purchase price where the plant capacity is lower than expected. | ☐ Yes ☐ No |

| Provision of warranties (including regarding information disclosed). | ☐ Yes ☐ No |

| Provision for certain lease and s.106 payments to be deducted if not discharged. | ☐ Yes ☐ No |

| Provisions about releasing any security from the site. | ☐ Yes ☐ No |

| Provisions about payment flows for payment amounts (i.e. monies to funders first). | ☐ Yes ☐ No |

| Performance warranties. | ☐ Yes ☐ No |

| Limitations on actions of the SPV pre-completion. | ☐ Yes ☐ No |

Local authorities should also consider the procurement issues arising under the Public Contracts Regulations 2015 from selecting any one or more of these options. For example, if a local authority were to elect to sell power from its solar farm to itself it would need to consider whether the purchase of this power was subject to procurement rules. Procurement issues are also likely to arise in any sleeving arrangement.

Checklist area 4 – procurement issues – in terms of asset ownership model

All local authorities (and sometimes their wholly owned companies) are subject to the Public Contracts Regulations 2015.

The Public Contracts Regulations 2015 apply when a contracting authority seeks offers in relation to:

- A proposed public supply contract.

- A proposed public works contract.

- A proposed public services contract.

Under the Public Contracts Regulations 2015, “public contracts” are defined to mean:

“contracts for pecuniary interest concluded in writing between one or more economic operators and one or more contracting authorities and having as their object the execution of works, the supply of products or the provision of services”.

Public contracts must therefore be:

- in writing; and

- for pecuniary interest or “consideration”.

Any local authority purchasing a solar farm would need to consider procurement issues whether undertaking a share purchase or an asset purchase.

Asset purchases are inherently riskier in terms of compliance with the Public Contracts Regulations 2015. This is because when contracts are transferred to any public body this can be construed as a new procurement which may be subject to challenge.

However in respect of a share purchase, when a local authority purchases an SPV from a developer and that SPV is pre-populated with relevant agreements, there are arguments as to whether relevant procurement rules apply.

We set out issues to consider in this regard below:

| CHECKLIST AREA | CONSIDERED? |

| Have you considered the Public Contracts Regulations 2015 in respect of your manner of purchase i.e. asset or share sale? Have you created an audit trail? | ☐ Yes ☐ No |

| If an asset sale, have you conducted an analysis of contracts being transferred for procurement purposes? | ☐ Yes ☐ No |

| If a share purchase, have you considered to what extent the developer has been retained? If the developer is providing services to the SPV being purchased, consider risk of procurement challenge arising. i.e. can the share purchase be construed as being a services arrangement. | ☐ Yes ☐ No |

| Following purchase, consider the extent to which the solar generator is subject to the Public Contracts Regulations 2015 (for example if it is wholly owned by a public body, it is likely to be caught). | ☐ Yes ☐ No |

| Even if the Public Contracts Regulations 2015 apply in a scenario have you explored the extent to which any exceptions to the obligation to procure might apply? Have you considered application of thresholds, option to use the negotiated procedure without a prior call for competition, exemptions to the application of the procurement regime (including in respect of regulation 12 of the Public Contracts Regulations 2015)? | ☐ Yes ☐ No |

Checklist area 5 – revenue agreement

A key part of any purchase of solar assets will be ensuring that the purchasing local authority can make a return on its investment. Local authorities should consider the revenue options for any solar farm they purchase.

Considering the following revenue options may be appropriate:

| Form of Agreement | Summary | Notes, Core Risks and Benefits (Summary Only) | Considered Y/N |

| Private Wire PPA | A direct supply by way of a constructed and purpose-built distribution connection. | This requires a local offtaker with an appropriate demand. Namely, whether this is available depends entirely on geography. A private wire solution would likely involve the offtaker seeking REGO benefits. Reliance on a single large customer(s). Electricity licensing exemptions will likely need to be applied if supply and distribution arises. Avoidance of embedded costs and network charges (however this could change over time if the regulatory regime changes). Back up generation/grid connection could be required due to the intermittent nature of solar generation. This will have a level of capacity charge. The benefit that can be achieved through a private wire approach is largely dependent on the cost of the private wire. If infrastructure is required, this may make the private wire approach uneconomic. Competition laws may require other generators to be permitted to connect. | ☐ Yes ☐ No |

| PPA with a Supplier | Enter into a power purchase agreement with a licensed supplier. The supplier pays the generator for its output but will include some allowance for the services it provides. | Terms depend on supplier. Most have their own standard form. Price is normally the only material point to move. Though potentially some sharing of residual embedded benefits. This may be temporary as a holding arrangement. Contact with suppliers would need to be made. Can seek different offerings. Premium for longer term arrangement. Pricing and timing of pricing is key. There are a range of options, but typically solar plants receive time of day / seasonal tariffs. There is inherent market risk with this – in particular going forwards – where there is no storage capacity at the plant there is a cannibalisation risk (namely this means that solar plants will all often be generating at similar times and prices will be low). Fixed prices can be possible but come at considerable market chip. SPV will normally take Change in Law risk. | ☐ Yes ☐ No |

| Sleeved PPA (Assumed to Self but could be to Third Party) | This is where a generator agrees to supply a customer. The agreements are then implemented via a supplier as the party that registers the meters, pays network charges (which it will typically pass through to the counterparties), and a fee for providing the service. | Third party supplier needed. Usually long and complex negotiation. Still attract network charges. Greater access to end users or self-supply. Supplier to provide top-up services. Usually reliant on supplier arrangements. Complex interaction with existing wider supply agreements. Sleeving contracts are often extended offtaker agreements, with price negotiations between the generator(s) and end consumer(s) generally creating a fixed price arrangement. Agreements are typically subject to re-negotiation on power price arrangements as well as change in law. A supplier is usually procured to provide top-up and spill arrangements. For their services, a supplier will usually charge a “tolling fee” to cover network charges, imbalance payments, top-up and spill and a service fee. | ☐ Yes ☐ No |

| Contract for Difference | A CfD results in a payment to the generator if the strike price (a pre-set price reflecting the costs of generating using low-carbon technology) is higher than the reference price (a measure of the average wholesale price of electricity in the GB market). The generator’s income is ‘topped-up’ to the strike price. If the reference price exceeds the strike price, the generator will pay back the difference. | Guaranteed revenue stream to SPV. Counterparty with LCCC. Protection for Change in Law. Requires an auction round – last solar round was in 2022 and auction rounds are now annual. Solar has secured more than 2.2GW at a price of £45.99/MWh in the latest Contracts for Difference (CfD) auction. Auction must yield an efficient strike price. Auction is competitive. Term is typically 15 years. PPA still required and SPV would have to obtain market price. Subsidy but an accepted one. No hedge for local authority’s own power prices. As such local authority is disadvantaged in periods where market price exceeds Strike Price. | ☐ Yes ☐ No |

| Synthetic PPA | A Synthetic PPA is an agreement between a generator and end customer that hedges the wholesale price element of the electricity bill using a contract for difference approach. A PPA will still be required to allocate the generator’s export to a supplier within national settlements. | Local authority can obtain Renewable Energy Guarantees of Origin (REGOs) (although this could be done by retirement). Guaranteed revenue stream to SPV. Limited efficacy where local authority wholly own SPV (though cash extraction may still be a benefit in periods of high market price). Greater benefit where SPV is not wholly owned. Local authority can extract upside in the event of high market price. Local authority is exposed on low market price. Both parties still require PPAs – these must identify wholesale price. Enhanced procurement risk (though arguably a financial instrument). Enhanced subsidy risk although this can be mitigated. Critical to set Strike Price at a defensible level. | ☐ Yes ☐ No |

| Traded Asset with route to market agreements (RTMA) | Mixed and optimised trading. This can take place via several routes to market – including the capacity market, balancing mechanism, power exchanges, dynamic response and other ancillary service. This is typically done via an aggregator. | Higher risk. Shifting market – i.e. changes to ancillary services. Back up of revenue stack. Solar can bid in capacity market. May be more efficient alongside battery storage. Local authority to procure an aggregator – typically done on a tolling or profit share basis. | ☐ Yes ☐ No |

Checklist area 6 – other agreements

We do not set out the details of every single agreement in this checklist and the requirements for such agreements. However we set out below the list of core contractual agreements (in addition to the Revenue Agreements (above)) that any solar farm project would likely require as a minimum. We have summarised what each of these agreements do above.

Local authorities should consider whether any solar farm they are to purchase has (or will have) the following or equivalents (and if not, they should consider why this is the case):

| CHECKLIST AREA | CONSIDERED? |

| Land Agreements for the Main Site – This may include a tiered approach with an Agreement to Lease followed by a Lease | ☐ Yes ☐ No |

| Grid Connection Agreement | ☐ Yes ☐ No |

| Planning Consent and Planning Agreements | ☐ Yes ☐ No |

| Ancillary Land Agreements – This may include wayleaves and easements for access and connection arrangements | ☐ Yes ☐ No |

| EPC Contract | ☐ Yes ☐ No |

| Equipment Supply Agreements | ☐ Yes ☐ No |

| Meter Agreement | ☐ Yes ☐ No |

| O&M Agreement | ☐ Yes ☐ No |

| Asset Management Agreement | ☐ Yes ☐ No |

| Is a Generation Licence in place? Consider also whether supply or distribution licences are required? NB any failure to obtain a required licence is a criminal offence. There are exemptions – if these are relied upon has detailed legal advice been sought? | ☐ Yes ☐ No |

We also set out some further specifics below in respect of these agreements. This list is not comprehensive, but we have tried to set out some of the material considerations in respect of key agreements:

Lease and agreement to lease

| CHECKLIST AREA | CONSIDERED? |

| Is there exclusivity over the site? | ☐ Yes ☐ No |

| Is the extent of site clearly identified? | ☐ Yes ☐ No |

| How long does the option or ability to enter into the lease last for? Are there conditions precedent? | ☐ Yes ☐ No |

| Are there any prohibitions on the landowner. Is the landowner required to provide any interim support prior to lease or exercise of the option (i.e. obligation to support the planning consents)? | ☐ Yes ☐ No |

| Are there any option fees or holding fees prior to lease payable to the landowner? | ☐ Yes ☐ No |

| CHECKLIST AREA | CONSIDERED? |

| Is the term length identified? | ☐ Yes ☐ No |

| Is use as a solar farm permitted? | ☐ Yes ☐ No |

| Is the rent payable clear? | ☐ Yes ☐ No |

| What are the break rights and compensation to the landowner for any early termination? | ☐ Yes ☐ No |

| What are the forfeiture rights of the landowner? | ☐ Yes ☐ No |

| Are there detailed decommissioning and reinstatement obligations? | ☐ Yes ☐ No |

| What are the insurance obligations? | ☐ Yes ☐ No |

| Are there any indemnities provided to landowner (against damage or losses causes by the development)? | ☐ Yes ☐ No |

| Are all ancillary rights required included? For example are rights granted to lay cables? | ☐ Yes ☐ No |

| What are the retained rights for the landowner? | ☐ Yes ☐ No |

Planning agreements

| CHECKLIST AREA | CONSIDERED? |

| Are voluntary contributions to the community (either through a lump sum or by way of a contractual undertaking) being made? | ☐ Yes ☐ No |

| Do obligations under s.106 of the Town and Country Planning Act 1990 (i.e. section 106 agreements) arise? If so, are the agreements with commitments that make the development proposal acceptable width=”100%” border=1 in planning terms? What is the cost of such commitments? | ☐ Yes ☐ No |

Grid connection

| CHECKLIST AREA | CONSIDERED? |

| Has a request made to the local distribution network operator using the appropriate DNO Connection Request Form? Does the request include the correct amount of capacity? | ☐ Yes ☐ No |

| Is any import capacity allowed for? | ☐ Yes ☐ No |

| Has a formal connection offer been received? If so, has it been accepted and have payments been made? | ☐ Yes ☐ No |

| What rights does the Connection Offer include for constraint (this relates to circumstances where the network operator does not have to allow you to export)? | ☐ Yes ☐ No |

| What are the on-going charges of the connection? | ☐ Yes ☐ No |

| What is the timing of any connection? | ☐ Yes ☐ No |

| If battery storage is envisaged is this facilitated by the connection arrangements? | ☐ Yes ☐ No |

Checklist area 7 – subsidy control

Issues in respect of subsidy control can arise during the acquisition of solar farm assets. Rules in respect of subsidies are (primarily) set out in the Subsidy Control Act 2022. Local authorities undertaking the purchase of solar farm assets should ensure that they have actively considered (and documented) whether any subsidy arises.

Where a subsidy arises it is not necessarily unlawful but must be considered against the subsidy control principles and the energy and environment principles set out in the Subsidy Control Act 2022.

The checklists below do not detail every point pertinent to a subsidy control assessment. However they flag typical areas where subsidies may arise in these transactions. We hope this will be a helpful trigger for those considering such transactions:

What counts as “financial assistance” that can trigger a subsidy

| CHECKLIST AREA | CONSIDERED? |

| Direct transfer of funds | ☐ Yes ☐ No |

| Contingent transfer of funds | ☐ Yes ☐ No |

| Foregoing of revenue that is otherwise due | ☐ Yes ☐ No |

| Provision of goods or services (at an off-market rate) | ☐ Yes ☐ No |

| Purchase of goods or services (at an off-market rate) | ☐ Yes ☐ No |

Scenarios to consider carefully in the context of a solar farm acquisition

| CHECKLIST AREA | CONSIDERED? |

| Purchase prices paid to developers – The local authority will need ensure these are demonstrably on market and obtain expert advice. | ☐ Yes ☐ No |

| Purchase price paid to service providers – If these are not tendered, rates will need to be demonstrably on market and the local authority will need to obtain expert advice. Authorities should be particularly wary of fees paid to any developer that continues to provide services. | ☐ Yes ☐ No |

| Payments from the local authority to any SPV that holds the solar assets. | ☐ Yes ☐ No |

| Grant funding received OR loans at an undervalue (including sources of funding such as UKIB). | ☐ Yes ☐ No |

| Funds received from Public Works Loan Boards and internal reserves – where the LA intends to invest relevant sums and therefore will use state resources for commercial purposes. | ☐ Yes ☐ No |

| Prices paid by the local authority to any SPV that holds the solar assets (where the local authority is the power offtaker). | ☐ Yes ☐ No |

Checklist area 8 – vires

For any local authority taking an action a critical test is whether that local authority has the power (vires) to take that action. This is particularly true where local authorities plan to charge and make a profit from the action. To buy a solar farm and operate it commercially local authorities need the power to do so.

In general terms local authorities will have the power to purchase and operate solar farm assets. The manner in which they do so (i.e. in-house or via an SPV and the manner in which they invest in it) will determine which powers to use.

We suggest three such powers below:

| CHECKLIST AREA | CONSIDERED? |

| Section 11 of the Local Government (Miscellaneous Provisions) Act 1976 when read with Section 2 of the Sale of Electricity by Local Authorities (England and Wales) Regulations 2010 – If any expenditure is incurred or income generated by the LA in connection with the powers conferred on it by these powers it must be accounted for separately in the LA’s accounts. This can allow ownership and generation of renewable energy in-house. | ☐ Yes ☐ No |

| Section 1 of the Localism Act 2011 – Note that s.4(2) of the Localism Act 2011 applies a restriction in that when a LA does things for a commercial purpose it must do them via a company. | ☐ Yes ☐ No |

| Section 12 of the Local Government Act 2003 – This is the power to invest. Local authorities must in all cases comply with the detailed guidance in order to use this power. | ☐ Yes ☐ No |

In respect of the vires argument for any solar farm purchase it will be critical to consider the connection of the local authority to the assets. For example are the assets in the administrative area of the local authority? Are the assets supplying the local authority (either directly or via sleeving)? Are the assets being used for carbon accounting benefits of the local authority? The greater the degree of separation between the assets and the local authority the more important it is that the local authority document exactly the vires case.

In addition to considering specific local authority powers, it will often be the case that local authorities will want to ensure an investment in solar assets represents best value. This is not just good practice but is also legally required. In this regard local authorities should consider:

| CHECKLIST AREA | CONSIDERED? |

| Have all viable options have been considered and assessed? Has this been independently reviewed and recorded? | ☐ Yes ☐ No |

| An investment has not been entered which is unprofitable width=”100%” border=1 – Has the local authority appropriately and conservatively profiled future electricity prices? Has the local authority considered future price risk (including risk of cannibalisation, risk of reform to embedded benefits and risk of constraint in the electricity market)? | ☐ Yes ☐ No |

| Local authorities, under s.3 of the Local Government Act 1999 should make arrangements to: | |

| Secure continuous improvement in the performance of the asset | ☐ Yes ☐ No |

| Maintain an appropriate balance between quality and whole life cost | ☐ Yes ☐ No |

| Have regard to efficiency, economy, effectiveness, and equal opportunities | ☐ Yes ☐ No |

| Contribute to sustainable development | ☐ Yes ☐ No |

Checklist area 9 – corporate, tax and accounting

While local authorities do have the power to operate solar assets in-house it is often prudent to use an SPV. This enables separate accounting treatment and insulates risk for the local authority. It also enables future sales of the solar assets more readily. Where a local authority uses an SPV (either by itself or alongside a third party) local authorities should consider the following:

Is a shareholder’s agreement required (appropriate if more than one shareholder of the spv)? If so, does it cover the following?

| CHECKLIST AREA | CONSIDERED? |

| Capital contribution by each shareholder | ☐ Yes ☐ No |

| Voting requirements | ☐ Yes ☐ No |

| Dividends policy | ☐ Yes ☐ No |

| Management outline for the SPV | ☐ Yes ☐ No |

| Conflicts of interests and non-competition clauses | ☐ Yes ☐ No |

| Pre-emption rights on disposal | ☐ Yes ☐ No |

If a local authority is the sole shareholder of a SPV limited by shares – consider the following:

| CHECKLIST AREA | CONSIDERED? |

| Do local authority standing orders enable ownership of the SPV? | ☐ Yes ☐ No |

| Use of bespoke articles of association for the SPV which reflect how the local authority would like the SPV to operate (including where it wishes to exercise control over the activities of the board of directors)? | ☐ Yes ☐ No |

| Decisions on whether to directly employ executive directors (preferably a minimum of three) who will be engaged full time in running the company – in this regard it is critical to ensure appropriate expertise. | ☐ Yes ☐ No |

| Consideration of any conflicts of interests which may arise with elected members appointed as directors concerning the duty to act in the best interests of the SPV. Note local authorities commonly amend the officer terms and conditions to state the officer may act as a director of the SPV and put the interests of the SPV first, as the law relating to directors requires. | ☐ Yes ☐ No |

| Consideration given to their position and responsibilities within the LA (generally s.151 officers should not be appointed to Boards)? | ☐ Yes ☐ No |

Tax and accounting

| CHECKLIST AREA | CONSIDERED? |

| Has the local authority sought tax advice at an early stage. Tax and accounting treatment should be a critical factor in determining which ownership structure to implement. The corporate structing and eventual structuring is decided, often driven by tax considerations. | ☐ Yes ☐ No |

Tax implications will depend on the structure but some key issues for the local authority to consider are:

| CHECKLIST AREA | CONSIDERED? |

| That the SPV will likely be subject to corporation tax on any of its profits. | ☐ Yes ☐ No |

| The SPV will be required to pay employer’s national insurance contributions (if any). | ☐ Yes ☐ No |

| The extent in which the company will need to register for VAT and any benefits if using Synthetic PPA. | ☐ Yes ☐ No |

| The stamp duty which would be payable on the consideration paid for the purchase of the shares in the SPV. | ☐ Yes ☐ No |

| Energy specific taxes such as the Energy Generator Levy | ☐ Yes ☐ No |

| In terms of asset purchases, a local authority buyer would need to consider: | |

| Availability of tax deductions for acquisitions costs (which will need to be reviewed by an accountant) | ☐ Yes ☐ No |

| VAT (a sale of assets is subject to VAT unless a particular asset is exempt – e.g. certain types of land and buildings) | ☐ Yes ☐ No |

| SDLT (for conveyances and transfers of land, tax is charged as a percentage of the chargeable consideration) | ☐ Yes ☐ No |

| Stamp duty (including stock and UK shares) | ☐ Yes ☐ No |

Checklist area 10 – decommissioning

It is never too early to think about liabilities on decommissioning. Often solar farms build a reserve or sinking fund to deal with any liabilities on decommissioning. This means local authorities need to understand at least the following as part of their day one business case:

| CHECKLIST AREA | CONSIDERED? |

| As per the planning consent what requirements exist for the removal of some or all of the plant and associated infrastructure from the site. | ☐ Yes ☐ No |

| As part of the land arrangements does the land have to be restored either to its original condition or a state to be agreed with the local planning authority. | ☐ Yes ☐ No |