This short guidance note is for cities and municipal governments and other public entities which can issue bonds. In three pages, it explains what Green City Bonds are, the projects which are eligible for green bond proceeds, how to become certified, and a five-step guide to issuing a Green City Bond.

Green bonds are like other bonds in every way except that the funds generated are specifically earmarked to finance sustainable infrastructure and services, such as renewable energy and public transport. Green City Bonds can be a source of low-cost capital for cities and municipalities to fund low-carbon buildings, renewable energy projects, metro rail systems and other climate-friendly projects. They can also provide other benefits such as increased and diversified investor base, better economic terms, as well as improved branding, media attention and enhanced citizen engagement.

Green bonds are like other bonds in every way except that the funds generated are specifically earmarked to finance sustainable infrastructure and services, such as renewable energy and public transport. Green City Bonds can be a source of low-cost capital for cities and municipalities to fund low-carbon buildings, renewable energy projects, metro rail systems and other climate-friendly projects. They can also provide other benefits such as increased and diversified investor base, better economic terms, as well as improved branding, media attention and enhanced citizen engagement.

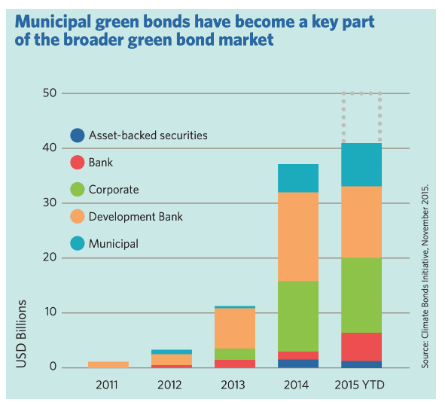

There is strong investor demand for green bonds, which are consistently oversubscribed. Pioneering issuers include the City of Stockholm, the City of Gothenburg, Transport for London, City of Johannesburg, San Francisco Public Utilities Corporation, the City of Ashville and others.

This short guidance note is for cities and municipal governments and other public entities which can issue bonds. In three pages, it explains what Green City Bonds are, the projects which are eligible for green bond proceeds, how to become certified, and a five-step guide to issuing a Green City Bond.

The Green Muni Bonds Playbook provides more detailed guidance, focussed on the United States.

Only around one in four cities have the ability to issue municipal bonds, according to C40 research published in Unlocking Climate Action in Megacities. City governments and public entities which cannot issue bonds can consider lobbying the national government for the right to do so. Read Climate Emergency, Urban Opportunity for more guidance on approaches and priorities for this, and evidence on national benefits that may support the argument.