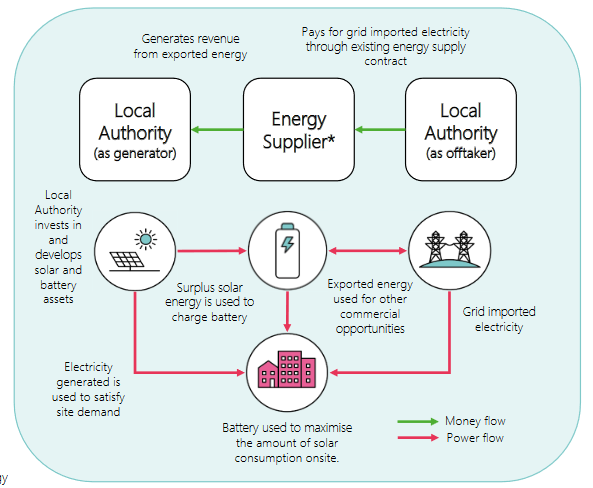

In this model, a battery storage asset is installed behind the meter to maximise the use of solar energy generated as well as other commercial opportunities

In this model, a battery storage asset is installed behind the meter to maximise the use of solar energy generated as well as other commercial opportunities

|

This model can be enacted by local authorities as follows:

It is possible for the local authority to act solely as the generator or offtaker in this business model. |

|

|

|

Key BenefitsFinancial and CO2

Other Benefits

|

Risks and Considerations

|

Most suitable for

- Technology – most commonly co-located with new solar projects but can be utilised on existing solar installations

- Technology – lithium-ion most commonly used but different types of storage will continue to develop in the market

- Most scalable when co-located with solar but the depends on factors like site location and time of use

- Higher revenue opportunities when located in constrained areas and when managed as part of a bigger portfolio of assets

- Significant roof space or space on site / where generation potential outweighs demand on site

Contracts required

Assuming the role of the local authority is as the asset owner and that the asset comprises a combination of generation and energy storage:

- Potential for synthetic or sleeved PPA for self-consumption

- Import PPA for the storage element (connection needs to be of a suitable size)

- Aggregation contract for the storage element

- Hardware will be required for battery control and site optimisation

- This could be the same as the aggregator or may be a sperate partner

- May look to setup a PPA for offtake for generation from the renewable asset and any peripheral supply from the storage

Contractual Considerations

- The size and scale of the assets will determine the market interest, both for the PPA and the aggregation contracts.

- Smaller schemes will be less attractive to the market and may attract less

- There can be a conflict for use of a shared grid connection for combined schemes and this needs to be managed through the offtake/aggregation contracts to ensure that arrangements are clear in the event that both assets require the grid export connection

Business Model

Viability

Viability

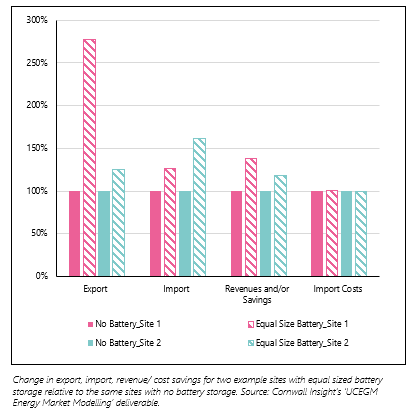

There are likely to be times when the amount of solar energy generated is greater than site demand. With battery storage, surplus solar energy can be stored and used to generate additional savings (maximising self-consumption). Battery storage can also offer additional benefits when combined with variable tariffs (required for arbitrage) and external control (charging and discharging on demand).

- Maximising Self Consumption: Storing surplus energy in batteries and discharging to satisfy site demand when solar energy is not available (e.g., at night).

- Arbitrage: Using battery storage to exploit different prices for electricity between peak and off-peak periods (i.e., charging at low prices and/or discharging at high prices).

- Flexibility (Grid) Services: Using battery storage to access flexibility markets available through the Electricity System Operator (ESO) or Distribution Network Operator (DNO).

Cost Structure

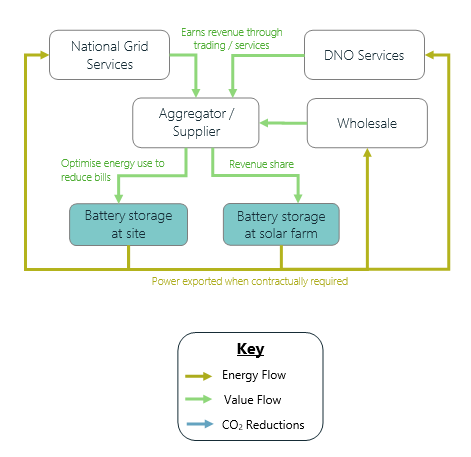

If the battery storage asset is intended to provide flexibility services, it is important to understand what markets are accessible. Flexibility markets have different eligibility criteria relating to battery size, discharge rate and other factors

Third parties such as aggregators and battery storage optimisers can trade energy on behalf of local authorities. They understand the complexities of optimising energy storage assets and know which revenue streams to target to maximise returns.

A commercial arrangement with an aggregator/ battery storage optimiser may be required for local authorities with smaller-scale batteries as they are able to pool flexibility from numerous providers which allows collective participation in markets. Different types of pricing models may be offered for these type of commercial arrangements; each with their own benefits and consideration.

Generator Benefits

Revenue Generation

Revenue may be generated from arbitrage or flexibility services. To benefit from arbitrage, a time of use energy tariff or an export arrangement will be required. Likewise, for flexibility services, an export arrangement will be required.

If the generator and offtaker are from different organisations, a private wire agreement (BtM PPA) will be required for the consumption of renewable energy onsite. This would provide an additional revenue stream for the offtaker.

Offtaker Benefit

Cost Savings

Cost-savings are achieved through energy bill reductions. If the generator and offtaker are the same entity, cost-savings will be achieved by directly offsetting grid-imported electricity. If they’re from different organisations, cost-savings will be achieved by paying a price for renewable electricity (as stipulated Private Wire/BtM PPA) which is lower than the retail price of electricity. The amount of cost-savings will depend on the percentage of self-consumption of renewable energy.

Revenue

Revenue share (%)

- ✓ Opportunity for local authority to benefit from high-market prices (when applicable)

- ✓ Some providers don’t charge for their services until the site is live and generating revenue (Flexitricity)

- ⚑ Risk Third-party and local authority share market risk and are exposed to fluctuations in market prices

- ⚑ Risk: Revenue generation can be inconsistent and unpredictable

Fixed Price

- ✓ Provides price certainty for exported power throughout the duration of the contract

- ✓ Market risk is taken on by third-party provider which provides protection against fluctuations in market prices for the local authority

- ⚑ Risk: Local authority does not benefit from periods of high market prices

- ⚑ Risk: To account for market risk, the third party may offer a more conservative price for export (i.e., less than market value).

Feasibility

Feasibility

Key Partnerships

|

Generator |

|

|

DNO |

|

|

Funding/ Finance Provider |

|

|

Offtaker |

|

|

Aggregator / Battery storage Optimiser |

|

|

Delivery Contractor |

|

|

Legal Advisor |

|

|

O&M Contractor |

|

|

Decommissioning Contractor |

|

Key Activities

Export from Battery Storage

- ‘Stacking’ is often performed to maximise revenue generation from eligible markets.

- A commercial agreement (optimisation contract) with an aggregator or battery storage optimiser is often required to trade energy on behalf of an asset owner as they understand the complexities of optimising energy storage assets and know which revenue streams to target to maximise returns.

- Although there are examples of local authorities that have secured optimisation contracts, they have typically been for large-scale storage assets (either stand-alone or are co-located with solar farms).

- For example, South Somerset District Council secured an optimisation contract with Limejump for 90MW of battery storage assets that they own across two sites

- Warrington Borough Council also secured an optimisation agreement with Statkraft for their 23MWp solar farm and 10MW battery storage facility.

- If unable to secure a commercial arrangement with an aggregator/ battery storage optimiser, a ‘solar storage’ tariff with a licensed SEG provider may be an alternative option.

Please note that some providers may only pay for electricity that is produced by onsite generation assets and not for electricity that was originally imported from the grid and exported later.

Renewable Energy Consumption onsite

- If the generator and offtaker are from different organisations, a private wire agreement will also be required for the consumption of renewable energy onsite.

Key Resources

Contract Length

- Longer contractual arrangements with aggregators and battery storage optimisers could help increase investor confidence and the likelihood of obtaining finance.

- However, findings from desk-based research suggest that optimisation contracts typically last 12-24 months.

- Although there are some cases of organisations securing longer-term optimisation contracts, the contracts awarded have been for large-scale battery storage assets.

- For example, Centrica Business Solutions have agreed to a 10-year contract for the optimisation of three battery storage plants (totalling 89MW) developed by Arlington Energy

Asset Control and Prioritisation

- There are several ways that a battery storage asset can generate revenue and/or cost savings.

- Accordingly, it is important that Parties agree on how the asset will be optimised throughout the duration of the contract.

- For example, some contracts may stipulate that the asset owner obtains the priority right to any stored energy from the battery (e.g., to satisfy onsite energy demand).

- When they do not require energy from the asset, provisions may be made to allow the aggregator/battery storage optimiser to generate revenue from export opportunities

- Having visibility on asset availability allows third party organisations to optimise which revenue streams to target.

- This is particularly important for organisations that access markets where assets must be available for dispatch upon request.

Asset Performance

- During discussions with aggregators/ battery storage optimisers, asset owners should also discuss the effect that optimisation could have on asset degradation and how asset performance risks will be addressed.

Desirability

Desirability

Value Proposition, Customer Relationships, Customer Segments, Channels

Value Proposition, Customer Relationships, Customer Segments, Channels

|

Desirability Checklist |

Considerations |

|

|

Revenue Generation |

Do you value revenue generation more than reducing costs? |

As generator, the local authority will not benefit from cost savings as they are not consuming renewable energy from the asset. Instead, they would have access to the following two revenue streams: Primary Revenue Stream: Selling renewable energy to third party offtaker – likely through a Private Wire/BtM PPA arrangement. Additional Revenue Stream(s): Selling surplus energy to aggregator/ battery storage optimiser (for arbitrage or flexibility services). If unable to secure a commercial arrangement with an aggregator/ battery storage optimiser, a ‘solar storage’ tariff with a licensed SEG provider may be an alternative option. |

|

How much do you value the opportunity to maximise revenue generation potential? |

One of the key factors that will influence revenue generation potential in this model is the way in which the battery is optimised to perform. Findings from desk-based research indicate that, for behind the meter systems, batteries are most often optimised to maximise the consumption of solar generation. Please refer to ‘Private Wire – Local Authority as Generator’ for further information on how revenue generation could be maximised under the Private Wire/ BtM PPA arrangement. Revenue generation potential from arbitrage and flexibility services will be influenced by the following factors: The volume of energy that is exported (kWh) The markets that the aggregator/ battery storage optimiser accesses on behalf of the local authority (some markets are more volatile than others). The structure of the commercial arrangement with the aggregator/ battery storage optimiser. If adopting a revenue share model with an aggregator/ battery storage optimiser, the local authority will be exposed to fluctuations in market prices meaning that revenue generation potential could vary significantly. |

|

|

Price Certainty |

Do you value revenue certainty? |

In combination with a fixed pricing structure, long-term arrangements with the offtaker can help increase price certainty for the local authority. Longer-term contracts could improve revenue certainty for commercial arrangements with aggregators/ battery storage providers (depending on the pricing structure adopted). However, it may be difficult to secure a long-term agreement with such stakeholders. As more battery storage assets come online, market saturation could occur for some DNO and ESO services (Cornwall Insight, 2023). This could change the way in which revenue streams are stacked by aggregators/ battery storage optimisers which, in turn, could also affect revenue certainty. |

|

Risks |

Are you willing to take on some risk? |

If opting for a revenue share model with the aggregator/ battery storage optimiser, the local authority would be exposed to market (price) risk. Although this could be partially mitigated by instead opting for fixed pricing structure, the local authority would still face some market risk due to potential market saturation in future. Depending on the contractual arrangement with the aggregator/ battery storage optimiser, there may be stipulations relating to the availability of the battery storage asset and the volume of energy available. Where this is the case, the local authority could also be exposed to some volume risk. For risks relating to the Private Wire/ BtM PPA arrangement, please refer to ‘Private Wire – Local Authority as Generator’. |

|

Resource Requirements |

Do you have the resource and expertise available to deliver renewable generation projects? |

The local authority will need to undertake sophisticated technical and commercial modelling to determine the optimal size of the renewable generation assets, the viability of the business model and how sensitive it is to changes in key parameters. This activity could be subcontracted to third-party organisations at a cost. |

|

Do you have resource available to undergo soft-market testing? |

Optimisation contracts with aggregators/ battery storage optimisers typically last 12-24 months. If unable to secure a longer-term agreement, the local authority would need to go out to tender numerous times for optimisation contracts throughout the lifetime of the project. Each time, commercial models would need to be updated to reflect any changes to commercial arrangements and assumptions. |

|

|

Do you have access to legal support? |

Legal support will be required when negotiating both contractual arrangements (i.e., the Private Wire/BtM PPA agreement with the third-party offtaker and the optimisation agreement with the aggregator/battery storage optimiser). |

|