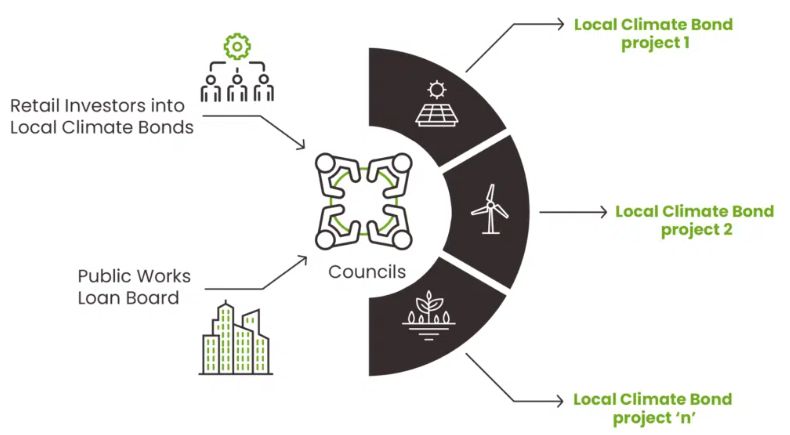

Local Climate Bonds have the potential to raise millions of pounds for green projects in the UK. They are finance products launched by councils to access cost-effective local funding for specific decarbonisation projects.

Resource

Local Climate Bonds have the potential to raise millions of pounds for green projects in the UK. They are finance products launched by councils to access cost-effective local funding for specific decarbonisation projects.

Experience Level:

FoundationLocal Climate Bonds have the potential to raise millions of pounds for green projects in the UK. They are finance products launched by councils to access cost-effective funding for specific decarbonisation projects, offering local people an opportunity to invest in their area in a way similar to crowdfunding and to make a return from doing so.

Designed to aid Local Authorities in developing robust, evidence-based plans to enable Net Zero.

Already have an account? Login