Synthetic PPAs decouple the physical flow of electricity from the financial flow.

When the Generator goes to the wholesale power market if the price they receive is less than the Strike Price then the Buyer pays to the Generator the short- fall. If the wholesale price is higher than the Strike Price then the Buyer receives the profit from the Generator. A synthetic PPA is purely a financial instrument separate from a PPA.

A synthetic PPA between the generator and the authority is similar to a contract for difference with payments between the generator and the authority adjusted as wholesale power prices change.

Contractual arrangements

A reference price for power will be required with consideration given as to whether this should reflect the underlying wholesale market price or whether an increase is warranted on this due to the social value elements coming from entering into a synthetic PPA with say a renewable energy community energy scheme.

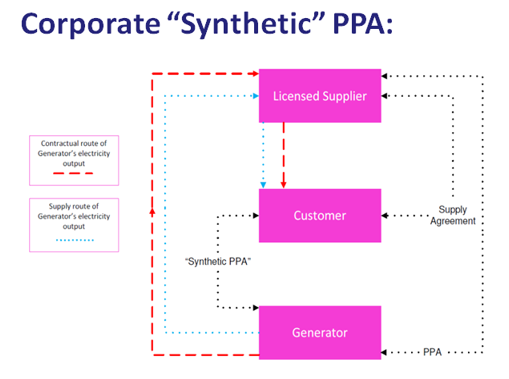

In addition to the synthetic PPA documentation, the Generator needs a separate PPA with a licensed supplier in respect of their export to the grid and the Buyer needs an unrelated PPA to deal with their power requirements.

- A contract with the third party supplier to purchase electricity. The contract would be for services, and be subject to the Public Contracts Regulations 2015 as listed above.

- A contract with a Generator under which payments would be made by the Buyer to the Generator where wholesale energy prices dropped below a “Strike Price”, and payments would be received by a Buyer where prices rise above the Strike Price in order to smooth fluctuations in wholesale power prices;

This is purely a financial arrangement which serves to smooth changes in energy price for the generator in respect of energy fluctuations. The Buyer is effectively paying a sum to the Generator to secure long-term piece of mind and there may be additional responsibilities on the Generator which are ancillary to the core purpose set out above which the Buyer needs the Generator to undertake. These may fall within the definition of “Services”.

CFD’s in Synthetic Power Purchase Agreements for Local Authorities

A synthetic PPA can provide the mechanism for sharing risk on the long term price of electricity (or a component of the price of electricity) reflecting either the wholesale market element of the electricity price or a base price willing to be paid by Local Authorities but it is is completely separate from the everyday requirement to source energy for an Authorities assets which require it which will still need to be undertaken via other means.

The Contract for Difference within a synthetic PPA serves to mitigate the risk of adverse changes in the electricity price for a Buyer (e.g. a Local Authority electricity purchaser) caused by electricity price fluctuations and provides security for both Generator and Buyer by setting the parameters which serve to offset losses elsewhere.

A strike price is agreed, which can vary in line with inflation/wholesale electricity pricing/green energy requirements/costs of development for example. Payments between the Buyer and Seller (e.g. a renewable energy generator/developer) over the period of the contract are then determined by the difference between this strike price and the market price for electricity. Settlement is then made according to the terms of the PPA, perhaps every three months for example.

Through the contract, the Buyer is able to obtain certainty over some of its energy costs over the long term and the Seller (generator/community energy organisation) is able to secure income per unit of energy generated (or perhaps a proportion of that generated) for a similar period. This secured income stream can be used to enable the Seller to construct a new renewable energy project. Note however that a pure Contract for Difference agreement does not need a renewable energy scheme sitting behind it to operate.

Without such a project however, the Seller will be exposed within the synthetic PPA to market price fluctuations without being able to hedge this against its ability to sell electricity on the open market and as such this creates risk for the Seller. In addition, until such a generation project is operating the Buyer may have a secured a hedge for a component of its energy costs, but it has not created or facilitated any of the other benefits.

Contracts for difference

A Contract for Difference (CfD) is a private contract between a low carbon electricity generator and the buyer of the generated energy that allows both parties to reduce risk of variation in delivered service

Procured CfDs

Whilst not requiring procurement, as CfDs fall outside of the procurement regulations required to be followed by Local Authorities, it might be that a Local Authority wishes to use the procurement process to meet other requirements, including ensuring best value for the Council.

A Contract for Difference provider could be procured through a call for tender operated by the Local Authority, or via Dynamic Procurement System run by a third party. As such, the agreement could include other components that would usually be included in a Power Purchase Agreement (PPA) and this would enable the green components and other Social Value attributes to be secured via a competitive tender. The PPA, or synthetic PPA could then be added to the suite of documents required in addition to the agreement that the Buyer needs to have with a licenced electricity supplier.

However, there are additional costs associated with running a procurement exercise itself and note there is likely to be an ongoing margin taken by any organisation running the DPS.

Un-procured CfDs

The Contract for Difference approach can be used by Local Authorities and other organisations to tie in present market rates over a long term, such as via interest rate swaps.

These are arranged at an agreed strike price with a bank that takes a margin, and payments are made between the two parties dependent on the difference between the strike price and the market rate. In the situation where the market rate is low at the beginning of the contract and the strike price is agreed near to that rate, if the market rate then rises the buyer will receive payment from the bank. As such, the Buyer is fixing in some component of the low interest rates. Local Authorities can secure these contracts without the need for a procurement exercise.

The risk to the Buyer (the Authority) from a similar arrangement in relation to electricity is that perhaps during the early years of the contract, the market price for electricity is lower than the strike price and so it is making payment to the Seller, whereas in later years the market price increases significantly, but in that time the Seller has become bankrupt. The Bristol City Council Sleeving Pool is examining such a risk and modelling existing generation sites to ensure the price paid enables the Seller to operate with a profit. Making such an agreement with a bank that has a strong credit rating would provide a sense of security to the Buyer whereas that might not be the case if the agreement was made directly with a small renewable energy generator.

Therefore, it might be worth exploring this opportunity with a bank that could provide loans to a renewable energy generator, such that the Contract for Difference agreement is between the Buyer and the bank. The bank could then agree to provide a loan for the construction of a new project and they would make the payments relating to the Contract for Difference to the Seller.

Contractual arrangements would likely involve:

- The Seller securing a standard Power Purchase Agreement with a supplier in order to export to the grid.

- The Buyer securing a contract with a licenced supplier of electricity for the purchase of electricity. This contract would be for services and will be subject to the Public Contracts Regulations 2015.

- A Contract for Difference between the Buyer and the Seller (or via a financial intermediary, such as a bank).

Green attributes of CfDs

There may be additional services which the Buyer wishes the Seller to provide, which are ancillary to the core purpose of the Contract for Difference contract. The Contract for Difference itself does not provide the Buyer with electricity, nor any component of green attributes associated with generating from renewable energy sources. And securing these green attributes could require some form of procurement that falls within the procurement regulations.

However, the Buyer may well be able to take comfort that contractual protection around these types of social and environmental objectives are not needed, in the light of other pre-existing non-contractual protections (such as any restrictions within the Seller’s constitution). Alternatively, or in addition, the procurement exercise performed to secure a licenced electricity supply could also include an agreement to secure REGOs (Renewable Energy Guarantees of Origin). The price of REGOs is very low and they are in themselves not widely recognised as providing additional benefit in terms of new renewable energy being generated.

They could be considered as just a paper exercise with some organisations paying a small amount to show that they have secured the rights over the green attributes, reducing the green component of the electricity supplied to other organisations (also see ‘green washing’ where organisations offset REGOs acquired against their brown power procurement within their carbon emission calculations) however, by securing both REGOs and electricity through a procurement exercise and agreeing a Strike Price through a pure Contract for Difference the Buyer will have:

- Secured an auditable source, demonstrating that it has purchased the green elements attributed to REGOs.

- Know that they have stimulated the development of a new renewable energy project through the Contracts for Difference arrangement.

Note that the Contracts for Difference in itself does not guarantee that the Seller, or the financial intermediary will build a new renewable energy project, or supply electricity from that project.

Perhaps an overarching agreement would need to be put in place to guarantee this at the risk of such agreement falling within procurement regulations. Alternatively, the Buyer could just rely on the acquisition of REGOs to demonstrate its support of green electricity until a new scheme is developed by the Seller, and once this scheme is generating the Buyer could then publicise its success in helping to establish a new renewable energy project. If a pure market rate was used in setting the strike price, then this uncertainty regarding whether the Seller is generating from a (new) renewable energy scheme might not be of particular issue to the Buyer as they will have secured a long term hedge for a component of their electricity supply.

If however the strike price took into account any Social Value and as such was higher than the present market rate that could otherwise be obtained for a Contract for Difference, then the Buyer would surely want to guarantee that the renewable energy project was built out and subsequently generates. Note any mechanism to ensure a project is built which involved a contractual obligation to perform a service by the Seller might itself lead it to fall within the procurement regulations.

Issues to explore include:

- It may be preferable for both sides if the payment is only made in relation to electricity generated on a particular site and exported to the grid, though whether this requirement would bring the Contracts for Difference agreement into the procurement regulations is uncertain. It may not as it could be seen as just another reference variable that is used to determine the settlement amounts being paid but this would have to be determined on a case by case basis.

- A decision will need to be made as to which market reference price for electricity is

There is an inherent risk as the market reference price used may not exactly match the

revenue stream for the Seller, nor the wholesale element of the Buyer’s electricity bill.

- Professional guidance on pricing levels is required and the cost of this needs to be factored into the project costings.

- In agreeing the strike price, consideration could be made on whether it purely reflects the market price, or whether there is an increase due to the Social Value elements stemming from a new renewable community energy scheme, for example.